If Cyber Insurance is just another product you keep hearing about but think it’s just one of those things you don’t really need, then perhaps it is time to rethink that.

A recent article which was published on an insurance industry website a few days ago, highlighted the seriousness of Cybercrime and the increasing need to protect your business (and family) from it wherever possible. The main take-out was:

Cyber attack, data loss and cyber extortion have been ranked as the top three risks for directors and officers in Australasia by a significant margin, with regulatory risk coming in at number four, according to the latest Directors’ Liability Survey from Willis Towers Watson and law firm Clyde & Co.

Of particular interest in the survey was how high Cybercrime ranked as a concern amongst business leaders, yet the uptake of Cyber Insurance remains low and slow whilst attacks have evolved at an alarming rate. We live in a volatile world with Cyber crime becoming the modern-day ammunition.

In fact, the Australian Cyber Security Centre issued this advice: Australian organisations should urgently adopt an enhanced cyber security posture on 28 April 2022 to warn organisations of the heightened threat of Russian state-sponsored cyber attacks on countries seen to be supporting Ukraine. So, the threat is real and it’s at our doorstep like never before.

We all know there are ways to protect businesses, and perhaps we’re hoping they will be enough. Microsoft’s latest Digital Defence Report has identified five cyber hygiene practices that can have a major impact on reducing threats. These five practices can protect you from 98% of cyber attacks:

However, should your systems still be penetrated, you will most likely suffer losses, potentially huge financial ones. Do you then put your hand in your pocket to help recover data and reinstate systems? Without insurance, will your business be able to do this to the extent that it may be required? Think of the fallout. What about the subsequent loss to your business each day it cannot operate? This is where Cyber Insurance certainly has a role to play in managing the risk in your business and helping you get back on track.

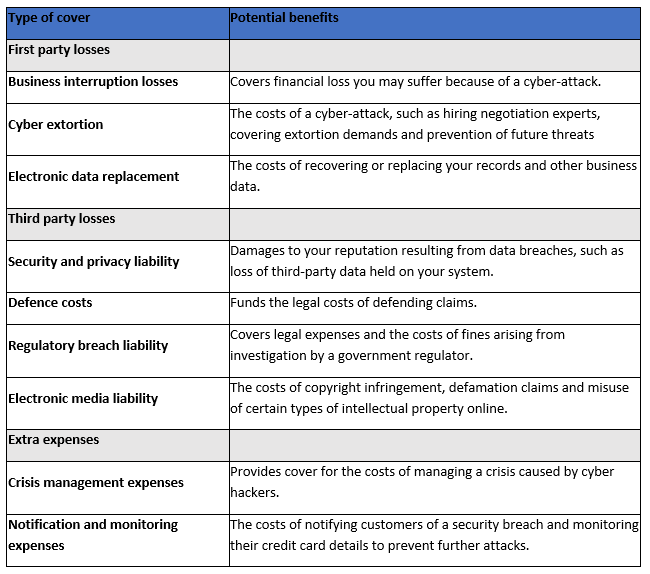

Here’s a snapshot of what it may cover:

Please contact Planned Cover to discuss why you need Cyber Insurance or click here to start your online Cyber Insurance quote.

VIC : Jonathan Lam (03) 8508 5400

NSW/ACT: Simon Gray (02) 9957 5700

QLD/NT: Karen Meiklejohn (07) 3017 1500

SA/TAS: Cos Cirocco (08) 8363 7366

WA: Kylie McGrath (08) 9261 1200