Drawing on our experience in insurance, construction and claims management, our team of risk managers at informed by Planned Cover reviews well over 1000 contracts in an average year, and presents seminars and webinars to thousands of attendees. These services are an included benefit to consultants who place their professional indemnity insurance through Planned Cover.

So it goes without saying that we are passionate believers in the benefits of risk management.

Early 2022, we conducted a survey of the biggest users of our services to find out whether you share our enthusiasm. Here’s what we discovered.

Contract Reviews

Our insurance reviews identify clauses in consultancy agreements that raise a clear risk of triggering exclusions in your professional indemnity (“PI”) insurance so as to expose you to uninsured liability, and clauses that impose unrealistic requirements on the terms or coverage of your PI policy. Presented in table form, they provide basic drafting solutions and, in some cases, example alterative clauses.

The overwhelming majority of contract review service users who responded to the survey agreed that our reviews help you understand and manage the risks faced by your business (95%) and provide expertise that you wouldn’t otherwise have access to (91%). 94% of you agree that you would recommend the contract review service to consultants not already using it, and almost half of you strongly agree. Feedback described our insurance reviews as “a very useful check which helps me challenge poor clauses in client written agreements”, and an “invaluable service for tricky clients”.

But we know how challenging it can be to convince clients to accept the recommendations in our reviews. Survey respondents noted the time pressures and practical difficulties created by the tender process, and the inflexible attitude of some government and institutional clients.

In spite of these challenges, 75% of you agreed that using the contract review service has helped you negotiate better contracts.

The commercial reality is that clients can rarely be persuaded to accept all of the changes you ask for. Instead, most clients expect a compromise where they accept some of your changes and you withdraw others. 76% of respondents to this question said that you “always” or “mostly” achieve some of the changes recommended in our review. A happy 4% said you always achieve most or all of those changes. It was only 22% who said the most common outcome is being unable to achieve any changes (and we would speculate that 22% is practices working predominantly on tendered government projects).

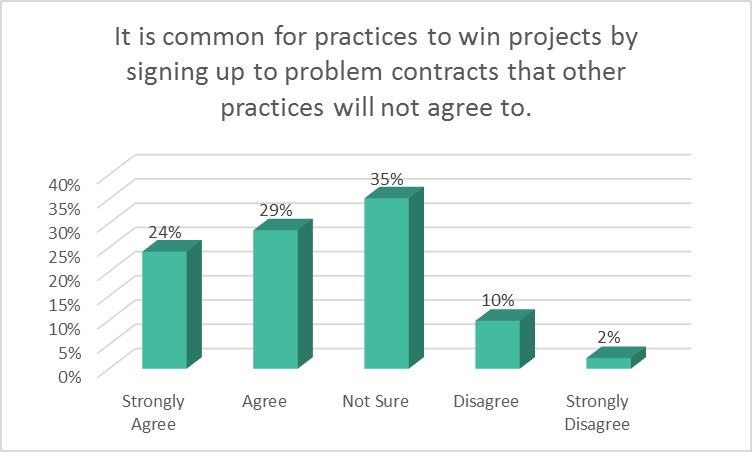

One common tactic used by clients to resist changes to their contracts is the suggestion that you are the only consultant holding out for changes, and that everyone has accepted their contract. Some client representatives express astonishment that anyone could question their contract – though after more than two decades of our review service, thankfully this attitude is becoming rare. This tactic has perhaps fuelled a feeling of isolation among consultants, as seen in the response to this survey question:

When we review contracts, and especially when we advise on amendments made during the ensuing negotiations, we are by definition dealing with those “troublemakers” who resist onerous client-drafted contracts. So we can attest that there are hundreds of you out there who have at some stage been (according to the client) the only consultant asking for changes. You are more numerous than your clients would like you to think!

To reframe your concerns as reflecting industry-wide objections, you can refer to the support of major representative bodies in Consult Australia’s Model Client Policy or the Institute of Architects’ Guiding Principles for Balanced and Insurable Client Architect Agreements (available to members on Acumen), or to the comparatively balanced risk allocation in Australian Standard 4122-2010 or AS 4904-2009.

Seminars

Our risk managers regularly present a series of one-hour seminars on about ten core topics relating to risk and insurance – from Contracts to Safe Design and Document Management. We share these in-house for practices with 10 or more professional staff, by bringing smaller practices together in a group setting, or sometimes by webinar. These are an included benefit for PI insurance clients of Planned Cover.

We supplement these with our series of ticketed one-off webinars where we cover more detailed topics, sometimes with the help of external specialist presenters.

Our mission in providing this education program is to spread the word about ongoing and emerging risks in the industry, and the best tools we can provide to address them.

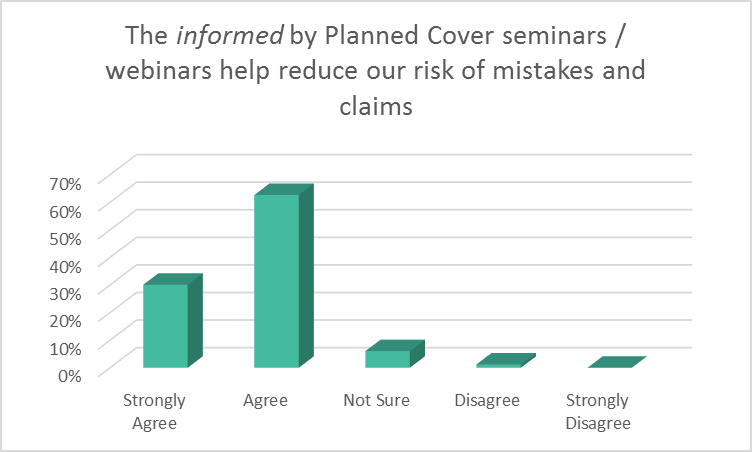

So we were delighted to find that the majority of respondents to these questions agreed that our seminar program helps staff “understand our legal obligations” (95%) and “understand the risks and commercial realities we face as a business” (96%). Another aim of our program is to supplement the internal training you’re already doing – and 89% of you agree that our seminars help reinforce to staff why it’s important to follow the company’s internal procedures.

Most importantly, 93% of you agreed that our seminars help reduce your risk of mistakes and claims. That’s exactly what we’re here for!

Other Communications

Another included benefit for PI insurance clients of Planned Cover is having access to our suite of 50 guidance documents on common industry issues that we call informed Practice Guides. We also write periodic articles for our mailing list and on LinkedIn.

Our survey reported that 86% of users of these services agree that they cover topics important to our business, and 76% agree they help keep all our staff aware of industry changes.

Anyone not already on the informed by Planned Cover mailing list can sign up here (for Planned Cover PI insurance clients who would like access to the Practice Guides) or here (for everyone else).

In conclusion, our survey has provided a fascinating glimpse into how all the work we put into our risk management services is perceived and used. We’re very grateful for the time of everyone who participated. And outside of surveys, we’re always open to feedback, good and bad, on the work we do – you can email us anytime.

Wendy Poulton

Manager Risk Services

informed by Planned Cover